Europe vs North America: 2024 Shared Mobility

Comparing NABSA's latest numbers from bike and scooter sharing in North America with Fluctuo's findings from the European Shared Mobility Index

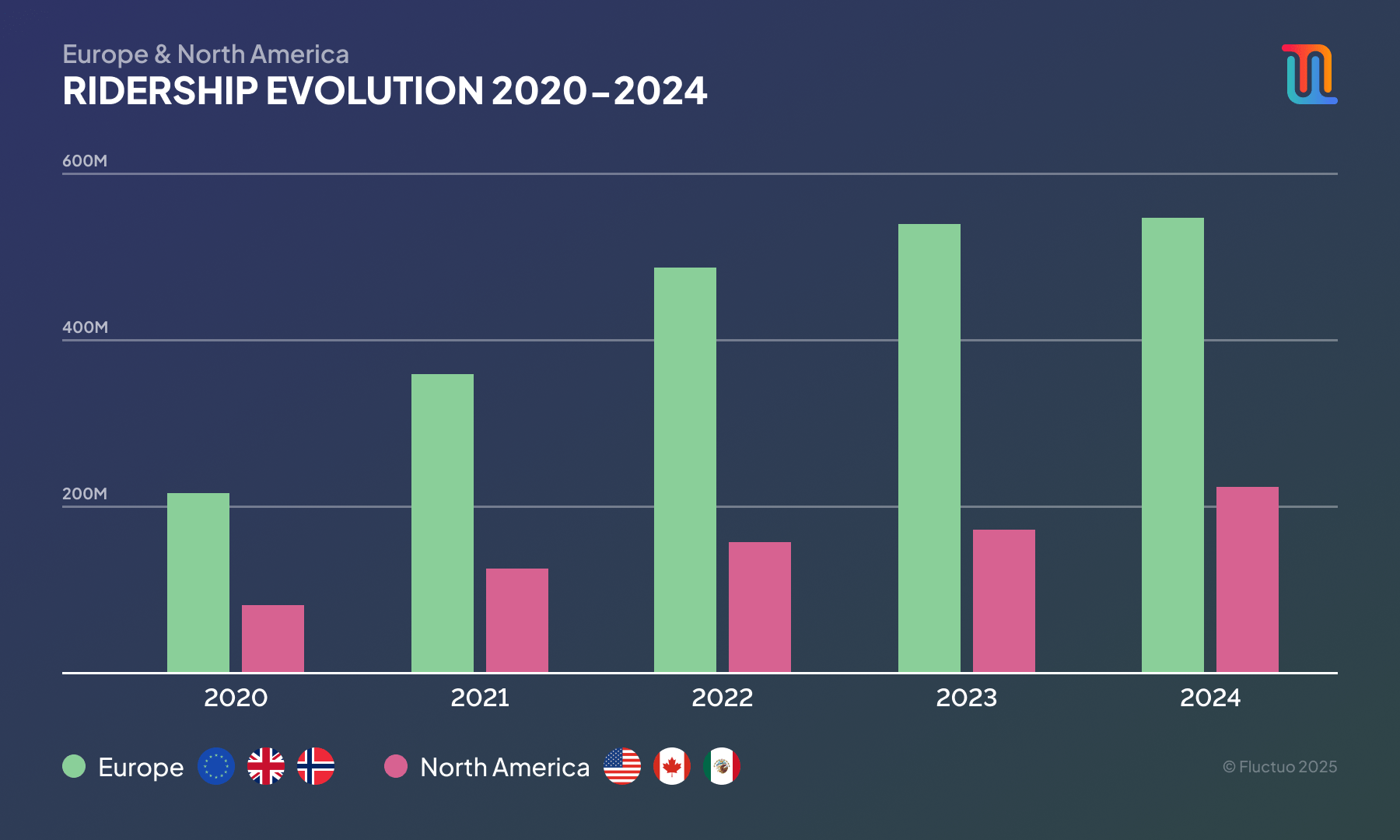

In August, NABSA released its 2024 State of the Industry Report, assessing all of the trends in shared mobility in Canada, Mexico & the USA. It finds that North Americans took an estimated 225 million trips on shared bikes and scooters in 2024, representing a 31% increase on 2023, setting a new ridership record.

But how does this compare to Europe?

Download the European Shared Mobility Index, sponsored by Aon, Lyft Urban Solutions, EIT Urban Mobility & POLIS Network.

Overall

If we compare NABSA’s findings to the 2024 European Shared Mobility Index, we see that Europe is still significantly ahead. Trips on scooters and station-based and dockless bikes in Europe reached 550 million, compared to 225 million in North America.

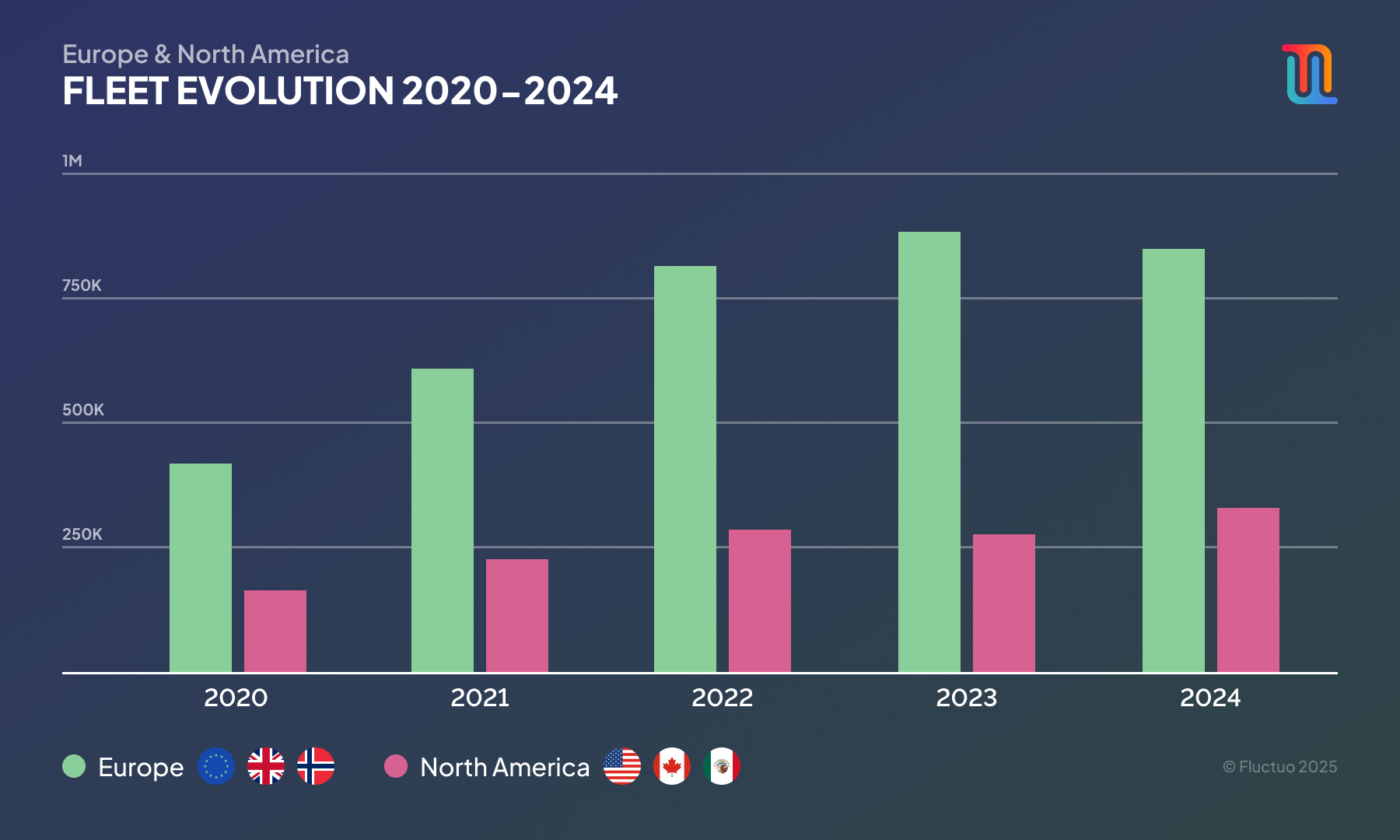

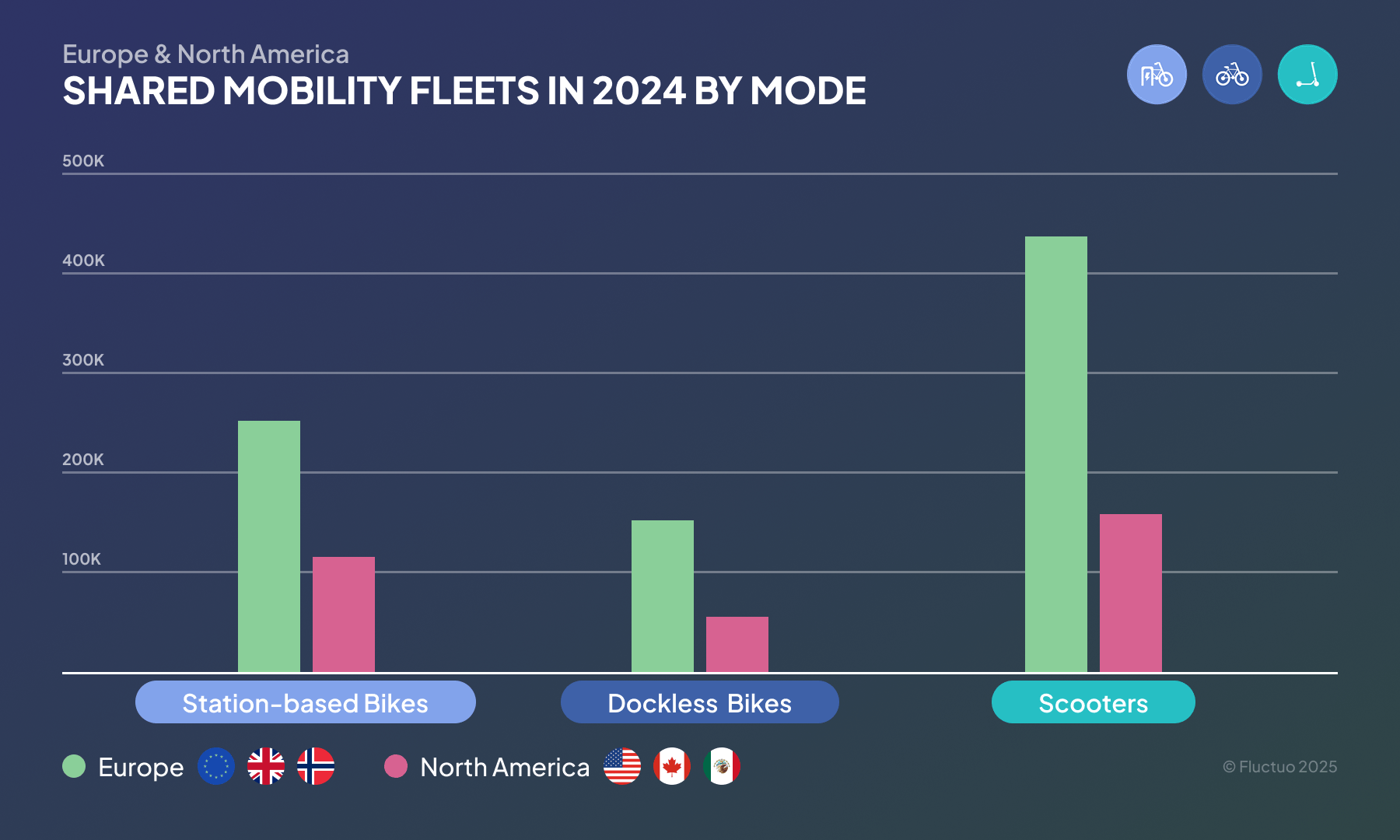

However, Europe had around 2.5 times the number of vehicles (849,000 vs 333,000) to produce twice as many trips.

The last 5 years of data show that shared mobility in North America is still on a steady rise, with more room to grow. However, Europe is experiencing a plateau due to regulations governing fleet sizes (caps) and on usage (parking, helmets).

It begs the question - how big can shared mobility in North America get?

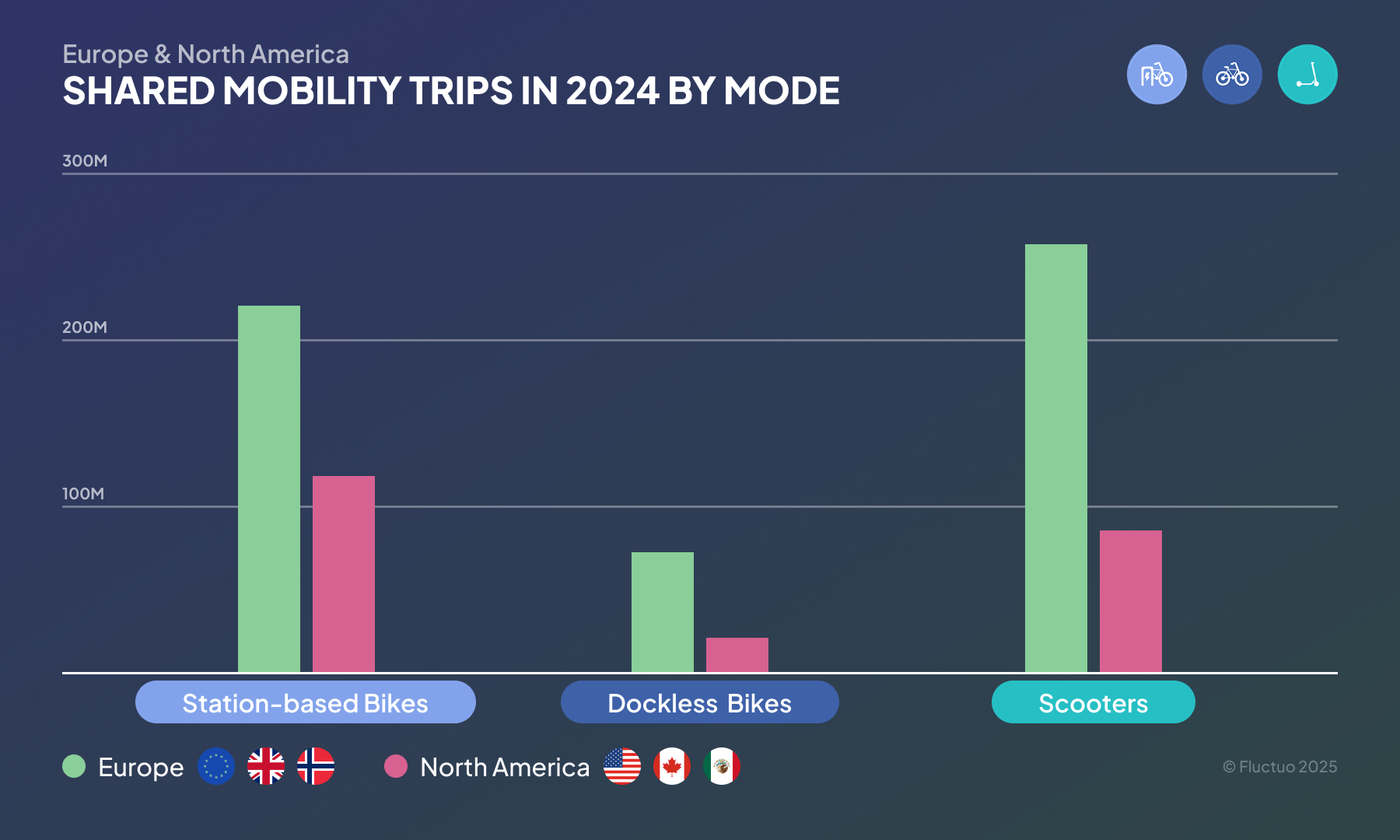

Let’s break down the data into each mode to see how the two regions compare and where the growth opportunities may lie.

Geographic and cultural differences

Urban form and cultural habits strongly shape shared mobility demand. European cities are much denser, with shorter average trip lengths and fewer wide arterial roads, making shared bikes and scooters a practical alternative to cars. By contrast, many North American cities are more car-dependent and spread out, limiting use cases outside of dense downtown cores.

Cycling culture also plays a crucial role. Everyday bike commuting is deeply ingrained in cities such as Amsterdam, Copenhagen, Paris and Berlin, creating a (potential) user base that sees shared bikes as a natural part of transportation. In the US and Canada, cycling is still often treated as recreation or sport, meaning shared bike adoption outside the largest metros has faced more cultural resistance.

Modal breakdown

Station-based bikes

In North America in 2024, bike trips accounted for 62% of all trips, of which 85% were made on station-based bikes.

Station-based bikes in North America recorded an average of 2.7 trips per vehicle per day (TVD), compared to just 2.4 in Europe. At first glance, it is surprising to see the station-based systems in North America outperforming those in Europe, but the difference lies in the number of bike systems in smaller cities in Europe, which reduce the overall TVD.

Dockless bikes

Dockless bikes remain far more popular in Europe than in North America. In 2024, 156,000 vehicles produced 72,500,000 trips in Europe (a driving force behind that growth being London and Paris), with only 56,000 bikes producing 21,700,000 trips across the pond.

Dockless bike fleets and ridership is expected to grow in both territories, but the ceiling in Europe is much higher, given the more-deeply-ingrained cycling culture.

Scooters

Scooters represent 48% of the total shared micromobility vehicles deployed across North America. Growth is steady, and despite having smaller overall numbers, the TVD for scooters in North America (1.7) is slightly higher than in Europe (1.6).

In Europe, scooters may well have already hit the largest fleet size that we will see. Despite more legislation pending in the UK, the reduction in fleet sizes across Europe and recent policy changes in Spain and Italy will see scooter fleets continue to decrease, but very slightly. In hundreds of European cities, scooters are a vital part of the mobility ecosystem, and will not be removed.

In North America, the challenge is scaling operations to serve the population of an entire city, and not just the urban core. The complexity that comes with this is a limiting factor for growth in cities where there is already shared mobility, however there is some potential for growth in new cities – if the financial model can be sustained.

Funding and public-private models

Another major difference lies in how systems are financed and managed. In North America, many of the strongest systems (Citi Bike NYC, Capital Bikeshare in Washington DC, Bay Wheels in San Francisco) rely on private sponsorships or partnerships. This corporate support has allowed station-based systems to scale up effectively, creating reliable and high-usage fleets.

Europe, on the other hand, tends to see stronger municipal or transit agency involvement. In Paris, Barcelona, and Berlin, bikeshare is often integrated into broader public transport networks, supported by city oversight and policy. This model ensures seamless connections with metros and buses, while also enabling the proliferation of large dockless deployments, especially in cities that favor flexibility over heavy station infrastructure.

Looking forward

The future trajectories of both regions will depend on structural choices.

In North America, the growth ceiling depends on whether shared mobility expands beyond the biggest metropolitan strongholds. If medium-sized cities embrace bikeshare and scooters—with supportive regulations and infrastructure—ridership could surge far beyond current levels.

In Europe, the outlook hinges on regulation. For growth to continue, barriers like strict fleet caps, mandatory helmet laws (Italy), and prolonged pilot programs (UK scooter trials) may need to be addressed. If these are relaxed and integration with rail and intercity travel continues, Europe could maintain leadership, though growth may be steadier than North America’s rapid acceleration.

For more analysis on Europe, download the European Shared Mobility Index, sponsored by Aon, Lyft Urban Solutions, EIT Urban Mobility & POLIS Network.